Hong Kong SPAC listing

There are roughly four ways for companies to go public: IPO, direct listing, backdoor listing, and SPAC. IPO is the main listing method. Unlike a normal IPO of a company, SPAC will first establish a company before going public. The company only has cash, no industry or assets, and its main purpose is to merge with the target company. The target company quickly achieved listing financing through mergers and acquisitions with already listed SPACs. One obtains equity returns and the other achieves rapid listing, forming a win-win situation for both. 为了争夺亚洲金融中心地位,2022年1月,香港正式推行SPAC业务。1月On the 17th, the Hong Kong Stock Exchange revealed that AquilaAcquisition Corporation, a company owned and indirectly controlled by China Merchants Bank, submitted a prospectus. It will become the first SPAC company on the Hong Kong Stock Exchange. In addition, there is also a star company that is listed on SPAC - Jia Yueting's Faraday Future. I won't talk too much about professional things here. Simply put, there are three reasons why companies choose to go public with SPAC: firstly, the listing time is short, usually only takes 6 months, and if it is fast, it can be completed in one month; Secondly, enterprises are more flexible and convenient to operate in the process of preparing for listing; Thirdly, there is a certain degree of certainty in the funds raised.

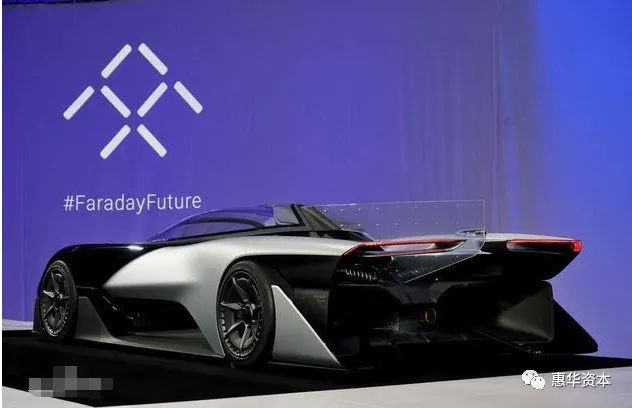

为了争夺亚洲金融中心地位,2022年1月,香港正式推行SPAC业务。1月On the 17th, the Hong Kong Stock Exchange revealed that AquilaAcquisition Corporation, a company owned and indirectly controlled by China Merchants Bank, submitted a prospectus. It will become the first SPAC company on the Hong Kong Stock Exchange. In addition, there is also a star company that is listed on SPAC - Jia Yueting's Faraday Future. I won't talk too much about professional things here. Simply put, there are three reasons why companies choose to go public with SPAC: firstly, the listing time is short, usually only takes 6 months, and if it is fast, it can be completed in one month; Secondly, enterprises are more flexible and convenient to operate in the process of preparing for listing; Thirdly, there is a certain degree of certainty in the funds raised.

Imagine that companies with potential to go public require high investment in the early stages and cannot meet IPO targets in a short period of time. In this way, through SPAC, these companies have the opportunity to go public. Judging from the current popularity of SPAC in the US capital market, SPAC may also spark a wave of domestic listings and bring new opportunities to various institutions.

IPOs are generally launched because companies have good projects and hope to seek cooperation funds. However, the listing of SPAC is different, as it first has funds and then seeks good projects in the market. In short, it is actually a "shell company" established first, and after completing the IPO fundraising, his only account is money. Then it will choose to merge with a company with real business and projects, ultimately achieving the target company's listing.

SPAC itself is just a shell company, and investors value future performance more because they believe in the initiator or buy stocks due to speculative factors. However, future performance is precisely the most difficult to predict. Enterprises such as life sciences, electric vehicles, and rockets that cannot see profits or even significant losses in the short term are expected to be listed through SPAC. Many of these enterprises are high-risk investment targets, and high risk corresponds to high returns. Taking former Facebook executive Chamath as an example, SPAC, which he launched with a cost of $25000 in 2017, acquired Virgin Galactic and went public in just two months. The market value immediately exceeded $6 billion, from 25000 to 250 million. So, for external investors, investing in a shell company is more like opening a blind box. You may open up a Tesla from Musk, or you may open up a Faraday future from Jia Yueting. This may sound speculative, but things in the world are always like this, there are always people who are unwilling to open it, and there are always people who like to open blind boxes.

The development of SPAC business on the Hong Kong Stock Exchange is equivalent to providing investors with opportunities to open blind boxes one by one. There will be more and more opportunities in the capital market to "take a shot and turn a bike into a motorcycle". However, the risk of such investment is too high, and the possibility of entering the mainland market in the short term is not very high. To experience such investment opportunities, it is estimated that mainland investors can only try opening an account in Hong Kong for the time being.

Please first Loginlater ~